What is a Stock Average Calculator?

A Stock Average Calculator is a free online tool that helps you to determine the average price of stocks in your portfolio when you go long or short at different prices.

By entering the number of stocks and the price per share, this calculator gives you the average cost per stock, total shares, and total investment.

How to Use the Stock Average Calculator?

Using the process is straightforward. Follow these steps:

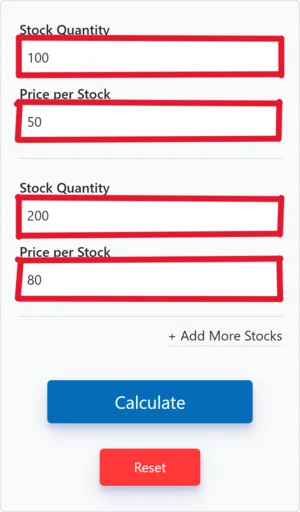

Enter Stock Quantity:

- In the first field, input the number of shares (or stock quantity) you purchased. For example, if you bought 100 shares, enter "100."

Enter Purchase Price:

- Next, input the price per share. If you purchased the stock at $50, enter "50" in the purchase price field.

Add Additional Stock Entries (Optional):

- If you made multiple purchases at different prices, click the “Add More Stocks” button to enter additional stock purchases.

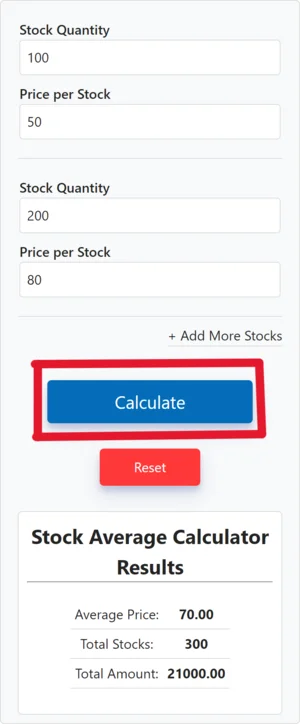

Click Calculate:

- Once all the stock quantities and prices are entered, click the “Calculate” button to see your results.

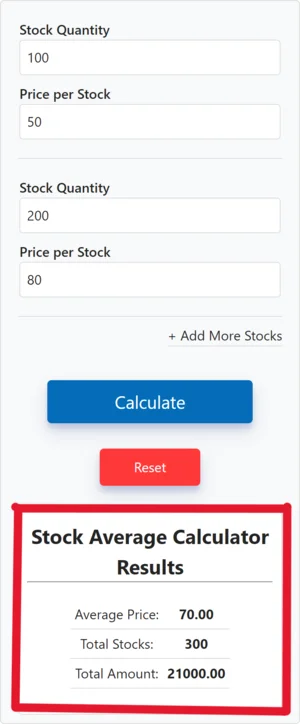

View Your Results:

- Average Stock Price: This is the weighted average price per share.

- Total Stock Quantity: The sum of all the stock quantities entered.

- Total Purchase Amount: The overall amount you have spent on the stocks.

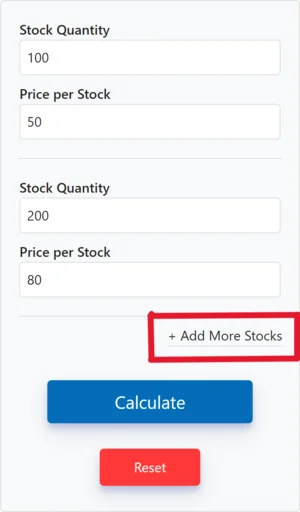

Adding More Stocks

If you want to include multiple stock prices. Here is how you can add more stocks:

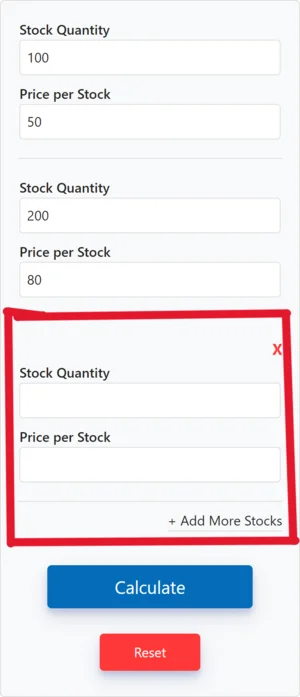

- Locate the Add More Stock Button: On the main interface of the Stock Average Calculator, you will find a button labeled “Add More Stock.”

- Click the Button: Simply click the “Add More Stock” button. This will create a new input field for you to enter another stock quantity and price.

- Input Stock Quantity and Price: In the newly created field, type in the quantity and price of the stock you wish to add. This feature allows you to keep adding as many stocks as you need, making it easy to calculate averages for your entire portfolio.

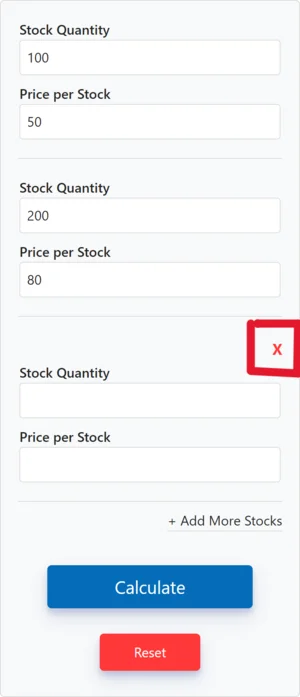

Removing Stocks

If you find that you have added more stocks than necessary, you can easily remove them. Here’s how:

- Identify the Stock Entry: Each stock input field will have a small cross icon (X) located at the top right corner.

- Click the Cross Icon: When you click on the cross icon, the particular stock input field will be removed from the calculator.

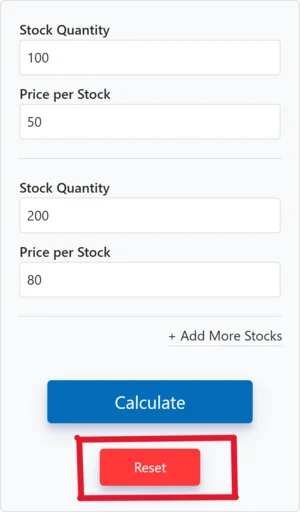

Resetting the Data

At any point, if you want to clear all entered stock prices and start fresh, the Stock Average Calculator provides you with an easy reset option.

The reset feature is particularly useful for users who want to start fresh without having to manually delete each stock entry.

Here is how you can reset your data:

- Find the Reset Button: Look for the “Reset” button on the calculator interface.

- Click the Reset Button: By clicking this button, all your entered stock prices will be cleared instantly.

- Start a New: After resetting, you can easily add new stock quantities and prices from scratch.

The Stock Average Calculator is designed to be user-friendly, allowing you to add, remove, and reset stock prices with ease.

By using these features, you can easily manage your stock portfolio and get accurate average price calculations.

Whether you are a seasoned investor or a beginner, this tool provides the necessary functions to enhance your stock trading experience.

Example of Using the Stock Average Price Calculator

Let’s suppose you made the following stock purchases:

- 100 shares at $50 per share

- 50 shares at $60 per share

Put these numbers into the calculator, you will get an average price of $53.33 per share, a total of 150 shares, and a total purchase amount of $8,000.

Why You Should Use a Stock Average Down Calculator?

- Avoid overpaying for stocks by getting information about your break-even point.

- Plan your next moves—buy, hold, or sell—based on the average stock price.

- Simplify calculations, saving time and reducing errors compared to manual calculations.

Key Features of Our Online Free Tool

- Multiple Stock Entries: Add as many stocks as you want to get the true average down price.

- Removing Stocks: If you see that you have added more stocks than necessary, you can easily remove them using the cross icon.

- Resetting the Data: You can use the reset button at any moment if you want to clear all inputs and start fresh.

- Instant Results: Calculate the total purchase amount, total number of stocks, and average price in seconds.

- User-Friendly Interface: Simple and easy-to-use tool for beginners to advanced traders and investors.

Tips for Using the Average Calculator Tool

- Keep your records updated: Always enter the latest stock quantities and prices.

- Use for multiple stocks: The tool can calculate the average price for different batches of the same stock.

- Check your break-even point: Use the calculator results to get the price at which your investment will break even or start generating profits.

How does our Stock Average Down Calculator Work?

A stock average calculator uses the total cost of shares and divides it by the total number of shares you own. This calculation provides the average price per share.

The Importance of Calculating Stock Average Price

It allows you to monitor their portfolio's performance accurately. By comparing the average price to the current market price, you can decide if your investments are profitable or have losses. Calculating stock average price helps you to buy or sell shares.

Advantages of Using a Stock Average Price Calculator

It saves time and effort by automating the calculation process and reducing manual calculations. It reduces the chances of errors that can occur when doing manual calculations.

Common Mistakes to Avoid When Average Down the Stock Price

When using a stock average down price calculator, avoid common mistakes that can impact the accuracy of the results. Some mistakes are:

- Using incorrect or outdated stock prices.

- Failing to reset the calculator with the latest input data.

- Misinterpreting the results and making wrong decisions.

- Relying solely on the tool without taking financial advice from financial professionals.

What is Averaging in The Stock Market?

We will understand what averaging is how averaging works, and when to do averaging when the price of a stock starts to fall.

We have three situations in a falling market, The first is to sell the stock making a loss. The second is to wait until the price rises and ignore the current conditions; the third is to see this as an opportunity and buy more company stocks.

Averaging in the stock market is a strategy to buy more company shares as its price falls, to lower the overall average buy price.

Buying the dips and adding to a position when the price falls can be profitable in a bull market but can increase losses in downtrends.

Suppose you bought 100 shares of ABC Limited for 500 each. Hence, our total investment is 50000. Suppose the price of ABC limited becomes 450 each. In this case, our investment becomes 45000 with an unrealized loss of 5000.

It can be seen as an opportunity to buy more company shares at a lower price. Assume that you purchased 50 shares of ABC Limited, so the total number of stakes is 150, and the average price of these 150 shares will be less than before.

It is calculated using a formula: average buying price equals p1xq1 plus p2xq2 and so on divided by the total number of shares. Where p1 is the price at which you bought shares initially, that is, rupees 500, and q1 is the quantity 100.

Similarly, p2 is the price you purchased later, 450, and q2 is 50. The total number of shares is 150. The average price of 150 shares in your portfolio is 483.34. When the cost of ABC Limited becomes more than 483.34, there will be some unrealized profit.

You cannot do averaging in every company because if the share price tends to fall, you will bear more loss.

You can only do averaging in two conditions. First, you can do averaging of blue-chip companies only. These companies have a reputation for operating profitably in good and bad times. Because in blue chip stocks, the risk of corporate bankruptcy is low.

They have a strong competitive position, low debt-to-equity ratio, solid cash flows, and other criteria best suited for averaging.

Second, you can look at the company's fundamentals before averaging a position.

Finally, the investor should confirm whether a decline in the stock is only temporary.

These are some of the essential steps you should consider before averaging down.

The method of averaging that we understand is averaging down because we average when the share price goes down.

However, if stock prices tend to go up, and the investors gain more confidence in the stock and start buying more is called averaging up.

The Pros and Cons of Averaging Down the Stocks

Averaging down is a very profitable strategy if the company you're buying has a history of continued success and has good fundamentals and a strong balance sheet.

Suppose the company you are investing in remains unchanged in everything. In that case, there are better investment strategies than assuming down on speculative assets like mean stocks.

Share prices increase mainly through hype and social media exposure. And most of these do not have any fundamental increases, or they don't have any strong business fundamentals.

They're just going up based on hype. When you're averaging down into stocks, they may never reach their all-time highs again.

It may just be one of these pump-and-dump situations, and now you're doubling and tripling up on your losses.

Many companies on the stock market never surpassed their all-time highs again. They went bankrupt, or they're being de-listed from the major stock exchanges.

Many companies dive down 70 to 90 percent from all-time highs, stay the same way for years, and never recover.

We can see this happen through the dot-com bubble in the early 2000s and late '90s, this occurred in the financial crisis in 2008, and then we just saw it happen last year with COVID-19.

There are companies that you could be averaging down in companies. If you kept averaging down in companies, you would have lost everything because of bankruptcy or went very low, the share price can go to zero.

Averaging down to blue chip stocks averaging down should be done on a selective basis for particular stocks rather than just as a catch-all strategy for every stock in a portfolio.

Averaging down is best for high-quality blue-chip stocks with low corporate bankruptcy risk. Blue Chips has a long-term track record of no debt and stable businesses.

In addition, they have reliable cash flow, good management, companies that provide substantial dividends, and a long track record history.

Averaging Down the Stock

Averaging down the stock is done by purchasing more shares at a lower price than the previous price, which provides lower costs per share if the process is repeated.

A slight upward move in share price can generate a better profit than just holding the stocks for a price rise.

The Mathematics of Averaging Down

In basic mathematics, the average price is a typical example of a range of prices.

It is calculated by taking the sum of the total cost spent and dividing it by the number of shares.

The average price reduces the stock into a single value, which is compared to previous prices to determine if the value is higher or lower than expected.

When investors or traders buy shares at different prices, they want to know the average price. Then investors decide that the stock is a profitable purchase.

For example, if you buy shares for $10 the first time and more shares of the same stake for $6 the next time, the average price of shares equals the total buying price divided by the total number of shares bought.

The higher the stock's price rises above the average price of your position, the more profit happens. The stock average calculator helps to do all the calculations easily and fast.

The Importance of Tracking Purchases

The information about share purchases is needed to calculate the average cost of the stock. It would help if it had confirmations from the brokerage for every trade.

If not, it can be called to the broker or check the online website where transactions are listed.

The buying price of stock typically varies daily due to the market; stock bought at different periods will cost different amounts of capital.

Strategic Approaches to Averaging Down

Averaging into a position can take to a different breakeven point from the initial buy.

Most investors buy stocks in one buy. Instead, many investors want to ease into a position.

Some might average into a share by investing money on the day over a while. Others want to buy in many parts.

Investors usually buy more stock when the market has unjustly sold it off. Most investors seem favorable when using the average stock calculator for averaging a position because it is a disciplined approach.

Still, it helps to reduce overall risk because this approach helps level out any of the market's volatility.

Utilizing the Average Down Calculator

For averaging down stock, the stock average down calculator does need a little information.

However, each investment will change the breakeven point of the position, in which the average cost is paid for the stock. An average price is a significant number, and it is easy to find out.

Understanding Volume-Weighted Average Price (VWAP)

Volume-weighted Average Price (VWAP) is calculated by totaling the money traded for every transaction and dividing it by the total shares traded. Or by using the online free tool, the average share calculator.

The weighted average price can be used when shares of the same stock are acquired in multiple transactions over time.

The volume-weighted average price is a fundamental metric for traders and investors.

Moving averages are used for various trend and reversal indicators in the share market.

Big institutional buyers and mutual funds use the VWAP ratio to help move into or out of stocks with a minor market shock. So, institutions wish to try to buy under the VWAP or sell over it.

In this way, the activities drive the price back toward the average rather than away.

Local traders tend to use VWAP more as a trend confirmation tool than a moving average.

If the price is over VWAP, they see only to initiate long positions. When the price is under VWAP, they only look to perform short positions.

Profitability Analysis and Cost Basis

When you sell a share, the net profits are compared to your average cost basis.

The deal is generally supposed to gain if your net income is more significant than the average cost basis. If it is less than what you paid, it means a loss.

The cost basis is the asset's initial value or buying price for tax plans.

It is set along the way for reinvested dividends and capital gains and return of capital distributions that are taxed later.

If shares are sold, the average price helps in determining what is taxable and what is not.

Gains are usually taxable, but losses are not.

Tax Implications of Stock Sales

Short-term gains are typically taxed at the regular rate.

However, long-term capital gains are taxed lower than the standard income tax rate.

Long-term and short-term gains are decided by how long they keep the shares.

Shares kept for more than one year are commonly supposed to be long-term, and less than a year is typically considered short-term.

Frequently Asked Questions (FAQs):

How do I use the Stock Average Calculator?

To use the calculator, simply enter the quantity of shares and the purchase price for each transaction. If you have multiple stock purchases, use the “Add More Stocks” button to input additional entries. Click "Calculate" to see the average price, total stocks, and total purchase amount.

Why is calculating the average stock price important?

Calculating the average price of your stock purchases allows you to understand the true cost of your investments. This helps in determining when to sell stocks for profit, avoid overpaying, and manage your portfolio effectively.

Can I calculate the average price for multiple stock purchases?

Yes! The Stock Average Calculator allows you to enter multiple stock purchases at different prices. It then calculates the weighted average price based on the quantities and prices you entered.

Is this Stock Average Calculator free to use?

Yes, the Stock Average Calculator is completely free to use for calculating the average stock prices of your investments.

Can I use the Stock Average Calculator for other financial assets?

While the tool is primarily designed for stocks, you can use it for other assets like mutual funds, ETFs, or bonds by entering the relevant quantities and prices.

Does the Stock Average Calculator account for transaction fees?

The current version of the calculator does not account for transaction fees, but you can manually adjust the prices by including fees in the purchase price. We may include fee calculation features in future updates.

How many stock purchases can I enter?

You can enter as much as you want to enter different stock purchases at a time. This allows you to calculate the average price for a series of transactions easily.

What is the formula used by the Stock Average Calculator?

The Stock Average Calculator uses the weighted average formula:

This provides the average price per stock based on your entered data.

Do I need an account to use the Stock Average Calculator?

No, you do not need to create an account to use the calculator. The tool is available for immediate use without any sign-up or login required.

Does this tool store my personal data and stock information?

No, we do not store your stock information and do not store any personal data.

References:

- Downey, L. (2022, April 5). Average Up: Overview of the trading strategy. Investopedia. https://www.investopedia.com/terms/a/averageup.asp

- Bull Market | Investor.gov. (n.d.). https://www.investor.gov/introduction-investing/investing-basics/glossary/bull-market

- Stocks with Largest 52-Week Losses - Yahoo Finance. (n.d.). https://finance.yahoo.com/u/yahoo-finance/watchlists/fiftytwo-wk-loss/?guccounter=1

- Wikipedia contributors. (2024, September 26). Dot-com bubble. Wikipedia. https://en.wikipedia.org/wiki/Dot-com_bubble

- Wikipedia contributors. (2024, September 23). 2007–2008 financial crisis. Wikipedia. https://en.wikipedia.org/wiki/2007%E2%80%932008_financial_crisis

- Chen, J. (2024, July 9). Blue chip meaning and examples. Investopedia. https://www.investopedia.com/terms/b/bluechip.asp

- James Royal, Ph.D. (2024, March 13). What is the long-term capital gains tax? Bankrate. https://www.bankrate.com/investing/long-term-capital-gains-tax/

- Team, C. (2023, October 4). Volume Weighted Adjusted Price (VWAP). Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/volume-weighted-adjusted-price-vwap/